As tech stocks continue a steep month-long decline, companies are increasingly facing a tough audience of investors when raising capital.

Published:

14 April 2000 y., Friday

The market swings and investors' actions have reverberated down the food chain from initial public offerings to early venture funding. There's still plenty of money, but investors are more selective in where they place their bets, what they demand in a company's business plan, and what valuations they're willing to pay, according to investment bankers and venture capitalists.

Although e-tailers were among the first to find investor interest slip, other sectors may also be feeling pressure, given the Nasdaq composite index's 25 percent decline since March 10.

Start-ups are facing new demands from institutional investors. Investors also want a company's IPO funds to last through the period until it is profitable, rather than serve as the first of several capital-raising events.

As a result, a start-up is left to raise less money and to give a larger percentage of the company than anticipated. And as companies seek their third or fourth round of financing, which usually tides a company over until it goes public, late-stage investors may be scarce.

Copying, publishing, announcing any information from the News.lt portal without written permission of News.lt editorial office is prohibited.

The most popular articles

The Gas Coordination Group, chaired by the Commission, met this afternoon to analyze in detail all elements of the preparedness of the EU and the Energy Community for a potential supply disruption in the Winter 2009/2010.

more »

The Gas Coordination Group, chaired by the Commission, met this afternoon to analyze in detail all elements of the preparedness of the EU and the Energy Community for a potential supply disruption in the Winter 2009/2010.

more »

In a meeting of the European Bank Coordination Initiative Group, held in Brussels, the parent banks of the nine largest banks operating in Romania reaffirmed their commitment to maintain their exposure to the country and ensure adequate capital levels over 10 percent for their affiliates.

more »

In a meeting of the European Bank Coordination Initiative Group, held in Brussels, the parent banks of the nine largest banks operating in Romania reaffirmed their commitment to maintain their exposure to the country and ensure adequate capital levels over 10 percent for their affiliates.

more »

Airline airBaltic has informed of its plans to resume some flights from Vilnius International Airport before the end of this year.

more »

Airline airBaltic has informed of its plans to resume some flights from Vilnius International Airport before the end of this year.

more »

The European Commission has approved under EC Treaty state aid rules the restructuring plan of Lloyds Banking Group.

more »

The European Commission has approved under EC Treaty state aid rules the restructuring plan of Lloyds Banking Group.

more »

"Finance and climate change" was under discussion at a 10 November hearing in parliament's Industry, Research and Energy Committee.

more »

"Finance and climate change" was under discussion at a 10 November hearing in parliament's Industry, Research and Energy Committee.

more »

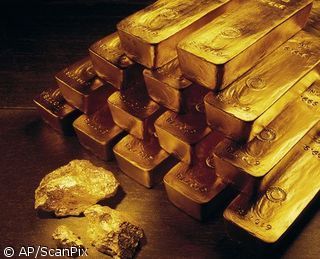

The International Monetary Fund announced today the sale of 2 metric tons of gold to the Bank of Mauritius, the nation’s central bank.

more »

The International Monetary Fund announced today the sale of 2 metric tons of gold to the Bank of Mauritius, the nation’s central bank.

more »

The euro area economy grew by 0.4% in the third quarter. Is the crisis over?

more »

The euro area economy grew by 0.4% in the third quarter. Is the crisis over?

more »

After lots were drawn, ten winners of Danske Bankas scholarships and one winner of an iPod shuffle player were established.

more »

After lots were drawn, ten winners of Danske Bankas scholarships and one winner of an iPod shuffle player were established.

more »

From 16 November 2009, AB Bank SNORAS network starts providing new products – one can sign agreements of “Finasta Asset Management” II level pension accumulation funds in all subdivisions of the bank.

more »

From 16 November 2009, AB Bank SNORAS network starts providing new products – one can sign agreements of “Finasta Asset Management” II level pension accumulation funds in all subdivisions of the bank.

more »

The expected turnaround in the Baltic Rim economies is likely to gradually improve the business opportunities for Nordic companies operating in the region.

more »

The expected turnaround in the Baltic Rim economies is likely to gradually improve the business opportunities for Nordic companies operating in the region.

more »