Online jeweler Blue Nile announced today that it has closed its fourth round of funding.

Published:

19 April 2000 y., Wednesday

Citing competitive pressures, the company declined to say how much it raised. Blue Nile plans to use the money to build its brand, improve its infrastructure and expand its product offerings, company chief executive Mark Vadon said.

Paul Allen's Vulcan Ventures led the investment round. Previous Blue Nile investors Bessemer Venture Partners, Trinity Ventures, Kleiner Perkins Caufield & Byers, Weiss Peck & Greer Venture Partners, and Integral Capital Partners also participated in the round.

Competition in the online luxury goods market has been growing in recent months. Amazon.com entered the niche in December with its $10 million investment in Ashford.com. Meanwhile prominent venture capital companies such as Sequoia Capital, CMGI @Ventures, and Idealab have backed a slew of luxury goods sites.

Unlike books, toys or groceries that are often sold at a discount to price-conscious consumers, retailers often sell luxury goods such as jewelry, diamonds and fine pens far above their cost. And the market for such goods is larger than that for books or music. Analysts estimate that the diamond jewelry market alone is $30 billion in the United States. But the market poses significant challenges online. Few consumers may be willing to spend hundreds or thousands of dollars to buy jewelry and other luxury goods without seeing the items first.

Copying, publishing, announcing any information from the News.lt portal without written permission of News.lt editorial office is prohibited.

The most popular articles

The Gas Coordination Group, chaired by the Commission, met this afternoon to analyze in detail all elements of the preparedness of the EU and the Energy Community for a potential supply disruption in the Winter 2009/2010.

more »

The Gas Coordination Group, chaired by the Commission, met this afternoon to analyze in detail all elements of the preparedness of the EU and the Energy Community for a potential supply disruption in the Winter 2009/2010.

more »

In a meeting of the European Bank Coordination Initiative Group, held in Brussels, the parent banks of the nine largest banks operating in Romania reaffirmed their commitment to maintain their exposure to the country and ensure adequate capital levels over 10 percent for their affiliates.

more »

In a meeting of the European Bank Coordination Initiative Group, held in Brussels, the parent banks of the nine largest banks operating in Romania reaffirmed their commitment to maintain their exposure to the country and ensure adequate capital levels over 10 percent for their affiliates.

more »

Airline airBaltic has informed of its plans to resume some flights from Vilnius International Airport before the end of this year.

more »

Airline airBaltic has informed of its plans to resume some flights from Vilnius International Airport before the end of this year.

more »

The European Commission has approved under EC Treaty state aid rules the restructuring plan of Lloyds Banking Group.

more »

The European Commission has approved under EC Treaty state aid rules the restructuring plan of Lloyds Banking Group.

more »

"Finance and climate change" was under discussion at a 10 November hearing in parliament's Industry, Research and Energy Committee.

more »

"Finance and climate change" was under discussion at a 10 November hearing in parliament's Industry, Research and Energy Committee.

more »

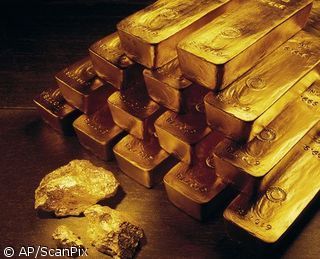

The International Monetary Fund announced today the sale of 2 metric tons of gold to the Bank of Mauritius, the nation’s central bank.

more »

The International Monetary Fund announced today the sale of 2 metric tons of gold to the Bank of Mauritius, the nation’s central bank.

more »

The euro area economy grew by 0.4% in the third quarter. Is the crisis over?

more »

The euro area economy grew by 0.4% in the third quarter. Is the crisis over?

more »

After lots were drawn, ten winners of Danske Bankas scholarships and one winner of an iPod shuffle player were established.

more »

After lots were drawn, ten winners of Danske Bankas scholarships and one winner of an iPod shuffle player were established.

more »

From 16 November 2009, AB Bank SNORAS network starts providing new products – one can sign agreements of “Finasta Asset Management” II level pension accumulation funds in all subdivisions of the bank.

more »

From 16 November 2009, AB Bank SNORAS network starts providing new products – one can sign agreements of “Finasta Asset Management” II level pension accumulation funds in all subdivisions of the bank.

more »

The expected turnaround in the Baltic Rim economies is likely to gradually improve the business opportunities for Nordic companies operating in the region.

more »

The expected turnaround in the Baltic Rim economies is likely to gradually improve the business opportunities for Nordic companies operating in the region.

more »