Hungary Continues Privatizations In the Next Two Years.

Published:

14 December 1999 y., Tuesday

Hungary said on Monday that it planned to complete its 10-year-old privatization program by selling stakes in the next two years in oil group MOL, electricity firm MVM, two drug makers and two banks. Officials of state privatization agency APV told a news conference that in the near future the agency would purchase the social security system_s 9.5 percent stake in pharmaceuticals maker Richter to boost its own stake to 25.5 percent. "The purchase will take place in the last days of the year," APV Deputy CEO Ferenc Szarvas said, adding that the price would be the turnover-weighted average price of the shares on the Budapest bourse in the last month before the deal. APV said in a statement that it expected to pay about Ft 22 billion ($87.58 million) for the Richter stake. The privatization agency is buying the stake because social security has to sell all its assets to finance its deficit. APV will sell the 25.5 percent Richter package in 2001, he said. Together with the Richter sale, the social security system will generate about Ft 70 billion from asset sales this year, compared with a Ft 53.7 billion target, APV said. Another significant sale to APV is likely to be a 25 percent stake in drug maker Human. APV expects to decide by February 28 how to go about privatizing these shares. Two recent tenders for selling the shares as one block failed because the price investors offered was low. APV is considering a sale in smaller chunks and may sell the shares in exchange for compensation coupons, it said. APV would also like to offer its remaining 30 percent stake in K&H Bank for coupons, but Belgium_s Kredietbank, which has a controlling stake, opposes a bourse listing because of the bank_s recent weak results. GE Capital, a controlling owner of Budapest Bank (BB), may also exercise its option next year to buy the state_s remaining 22.8 percent in the bank. The state may sell its 25 percent remaining stake in oil and gas group MOL next year, but this will depend on resolving uncertainty created by MOL_s merger talks with Croatian oil company INA.

Copying, publishing, announcing any information from the News.lt portal without written permission of News.lt editorial office is prohibited.

The most popular articles

The Gas Coordination Group, chaired by the Commission, met this afternoon to analyze in detail all elements of the preparedness of the EU and the Energy Community for a potential supply disruption in the Winter 2009/2010.

more »

The Gas Coordination Group, chaired by the Commission, met this afternoon to analyze in detail all elements of the preparedness of the EU and the Energy Community for a potential supply disruption in the Winter 2009/2010.

more »

In a meeting of the European Bank Coordination Initiative Group, held in Brussels, the parent banks of the nine largest banks operating in Romania reaffirmed their commitment to maintain their exposure to the country and ensure adequate capital levels over 10 percent for their affiliates.

more »

In a meeting of the European Bank Coordination Initiative Group, held in Brussels, the parent banks of the nine largest banks operating in Romania reaffirmed their commitment to maintain their exposure to the country and ensure adequate capital levels over 10 percent for their affiliates.

more »

Airline airBaltic has informed of its plans to resume some flights from Vilnius International Airport before the end of this year.

more »

Airline airBaltic has informed of its plans to resume some flights from Vilnius International Airport before the end of this year.

more »

The European Commission has approved under EC Treaty state aid rules the restructuring plan of Lloyds Banking Group.

more »

The European Commission has approved under EC Treaty state aid rules the restructuring plan of Lloyds Banking Group.

more »

"Finance and climate change" was under discussion at a 10 November hearing in parliament's Industry, Research and Energy Committee.

more »

"Finance and climate change" was under discussion at a 10 November hearing in parliament's Industry, Research and Energy Committee.

more »

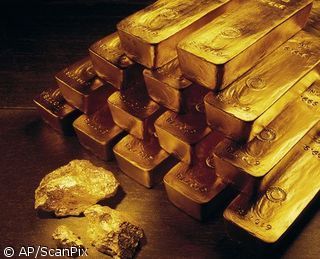

The International Monetary Fund announced today the sale of 2 metric tons of gold to the Bank of Mauritius, the nation’s central bank.

more »

The International Monetary Fund announced today the sale of 2 metric tons of gold to the Bank of Mauritius, the nation’s central bank.

more »

The euro area economy grew by 0.4% in the third quarter. Is the crisis over?

more »

The euro area economy grew by 0.4% in the third quarter. Is the crisis over?

more »

After lots were drawn, ten winners of Danske Bankas scholarships and one winner of an iPod shuffle player were established.

more »

After lots were drawn, ten winners of Danske Bankas scholarships and one winner of an iPod shuffle player were established.

more »

From 16 November 2009, AB Bank SNORAS network starts providing new products – one can sign agreements of “Finasta Asset Management” II level pension accumulation funds in all subdivisions of the bank.

more »

From 16 November 2009, AB Bank SNORAS network starts providing new products – one can sign agreements of “Finasta Asset Management” II level pension accumulation funds in all subdivisions of the bank.

more »

The expected turnaround in the Baltic Rim economies is likely to gradually improve the business opportunities for Nordic companies operating in the region.

more »

The expected turnaround in the Baltic Rim economies is likely to gradually improve the business opportunities for Nordic companies operating in the region.

more »