Medical supplies supply the next B2B wave.

Published:

20 October 1999 y., Wednesday

Neoforma.com filed Friday for an IPO, and privately held Medibuy.com plans to close a $40 million round of funding within a week. Both companies want to be Web middlemen handling some of the $140 billion spent worldwide by hospitals and medical centers on everything from tongue depressors to multi-million-dollar imaging devices. Those who calculate the total budgets of medical procurement people-which can include such unrelated items as office furniture and rock salt used in parking lots-say worldwide expenditures are $300 billion. Medibuy.com, Neoforma.com, and others like them plan to make money by taking a 3 to 6 percent commission of each transaction they broker in the fragmented medical market. In the U.S. alone, 6,000 hospitals and 175,000 doctors_ offices purchase products from 20,000 manufacturers and distributors. In its filing with the U.S. Securities and Exchange Commission for a $75 million IPO, Neoforma.com disclosed that it received a final $70 million round of private funding this month worth $5.68 a share. Dell Computer kicked in $25 million of the total, acquiring a 9 percent stake in the company. The recent funding round raises the value of Neoforma.com to $275 million. Back-of-the-envelopearithmetic shows that if Neoforma.com prices the IPO at a conservative $10 a share, the company will be worth $550 million even before its stock begins trading. That_s a high price for a company that lost $8.1 million on $7,000 revenues for six months ended June 30. It looks especially steep for a company that_s not likely to make a penny for a few years. Yet the company appears to be a bargain compared with the many Internet IPOs with dubious business models that have climbed to $1 billion in market capitalization or more in trading. Both Neoforma.com and Medibuy.com have been building their sites for the past three years. At the end of June they still weren_t officially up and running. Medibuy.com, backed by Kleiner Perkins Caufield & Byers, has raised $50 million so far in venture funding. CEO Dennis Murphy said in August that he expected to receive $40 million more that month from "strategic partners in related businesses." Now he says that money has not yet arrived, but he expects it within the next week. Mr. Murphy is still mum on his IPO plans. Medibuy.com may be the leader in established relationships, a key factor for distribution networks.

Copying, publishing, announcing any information from the News.lt portal without written permission of News.lt editorial office is prohibited.

The most popular articles

Software company announced new structure_ of it_s business.

more »

Wincor Nixdorf supports banks in networking their delivery channels and enables new customer services by continuously developing its ProClassic/Enterprise Retail Banking Solution Suite.

more »

Wincor Nixdorf supports banks in networking their delivery channels and enables new customer services by continuously developing its ProClassic/Enterprise Retail Banking Solution Suite.

more »

From the opening of new branches to their operation and modernization – Wincor Nixdorf presents its end-to-end offer for a branch’s entire lifecycle and shows what state-of-the-art branch design can look like.

more »

From the opening of new branches to their operation and modernization – Wincor Nixdorf presents its end-to-end offer for a branch’s entire lifecycle and shows what state-of-the-art branch design can look like.

more »

Visa will hold its first one-day Key Management Training series in conjunction with ATMIA.

more »

Visa will hold its first one-day Key Management Training series in conjunction with ATMIA.

more »

The United States is at the center of many conversations in Europe these days.

more »

The United States is at the center of many conversations in Europe these days.

more »

Wincor Nixdorf is moving toward the new European standard EPAS (Electronic Protocols Application Software), which is now available as part of the introduction of SEPA for integrating cashless payment solutions in checkouts.

more »

Wincor Nixdorf is moving toward the new European standard EPAS (Electronic Protocols Application Software), which is now available as part of the introduction of SEPA for integrating cashless payment solutions in checkouts.

more »

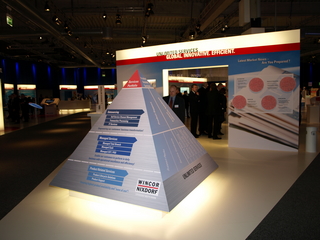

Wincor Nixdorf expands Professional Services portfolio.

more »

Wincor Nixdorf expands Professional Services portfolio.

more »

Over the years, Wincor World has developed into a premier branch event. It is an important communications forum for the 40 partner companies participating in the event and provides an ideal platform for exhibiting more than 600 IT solutions and services.

more »

Over the years, Wincor World has developed into a premier branch event. It is an important communications forum for the 40 partner companies participating in the event and provides an ideal platform for exhibiting more than 600 IT solutions and services.

more »

Three-tier concept for more security.

more »

Three-tier concept for more security.

more »

The transfer and processing of transactions with debit and credit cards generates a high administration overhead for financial institutes and retail companies alike, and also requires a suitable IT infrastructure.

more »

The transfer and processing of transactions with debit and credit cards generates a high administration overhead for financial institutes and retail companies alike, and also requires a suitable IT infrastructure.

more »

International Education Assessment Leaders PISA and TIMSS Endorse Project, Plan to Incorporate Key Findings into Next Versions of International Benchmarks

more »

International Education Assessment Leaders PISA and TIMSS Endorse Project, Plan to Incorporate Key Findings into Next Versions of International Benchmarks

more »